Having trouble coping with debt at various institutions? Exhausted running all over from one institution to the next month end paying your different debts? Looking to consolidate all or some of your debts into one with one easy and affordable monthly payment? We offer Debt Consolidation loans to members.

Come in or apply online for such a loan using our downloadable or online forms on our website in our "Forms" section.

Requirements:

Required Share Deposit (a percentage of loan amount requested. This varies based on loan amount, level of risk, etc)

Signed pay off statements from the creditors you owe

Job Letter and salary slips where applicable

If Self-employed, evidence of income (bank statements, income and expenditure statements, etc)

Other forms of collateral (where necessary)

Education is often referred to as the great equalizer. Investing in your education or that of your children is priceless. Sadly the cost of education can be so prohibitive for many, especially secondary and tertiary education. We at the Fond St Jacques Credit Union understand that all too well. It is for this reason we introduced our Education/Student's Loans. No matter the educational level you are looking for assistance for, we are ready to assist.

Come in or apply online for such a loan using our downloadable or online forms on our website in our "Forms" section.

Requirements:

Job Letter from Employer stating length of service, employment status, salary/wage and other emoluments

Salary Slips (Latest)

If self-employed - evidence of income such as bank statement, financial statements, etc

Required Share Deposit (a percentage of loan amount requested. This varies based on loan amount, level of risk, etc)

Evidence of admittance into school and associated costs

Suitable Co-maker or Surety (if necessary)

Life Insurance assigned to us (where necessary)

Suitable collateral (where necessary)

Need some funds to assist with special occasions like weddings, funerals, milestone birthdays and other important once in a lifetime events? We have loans to help our members, such precious occasions and activities.

Come in or apply online for such a loan using our downloadable or online forms on our website in our "Forms" section.

REQUIREMENTS

Job Letter from Employer stating length of service, employment status, salary/wage and other emoluments

3 Salary Slips (Latest)

If self-employed - evidence of income such as bank statement, financial statements, etc

Required Share Deposit (a percentage of loan amount requested. This varies based on type of loan, level of risks, etc

Evidence of the existence of the occasion.

Open Bill/Invoice from suppliers/service providers

Suitable co-maker (where necessary

Member and Non-members (persons/organisation with or without the minimum of XCD$100 worth of Permanent/Equity Shares) also have the option of saving with us on Ordinary Deposit accounts. These accounts facilitate persons with the savings of money without specific purposes or funds that are likely to be withdrawn in the short run. They can make unrestricted and unlimited withdrawals as they wish with no attached fees.

Person/organisation can arrange with us to set-up special deposit accounts to assist with savings for specific purposes. These accounts will have specific instructions and restrictions established by the member/depositor.

Similar to Ordinary/Withdraw-able shares, Deposit accounts are paid interest quarterly usually in March, June, September and December. The interest rates paid out are determined by the Board of Directors.

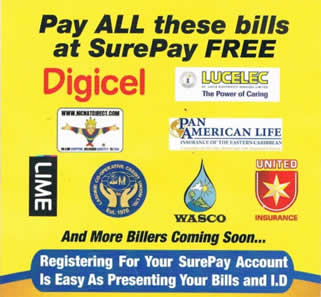

This is an electronic bill payment system which securely handles the payments to billers on behalf of the customers at no cost to them.

Walk into the Credit Union with your bills (does not have to be current bill), hand them to the cashier and indicate how much you want to pay towards each bill. You will receive an official proof of payment receipt for your records.

The SurePay system is constantly in communication with each of the biller's accounting system, updating payments to each account on an on-going basis which means all account information is kept current and secure. It also means that you can pay bills on the day they are due and no risk penalty.

If you wish to register for a SurePay account, provide one form of I.D. and the bills which you want registered to your account. Registration is free of charge. This means that you will never have to walk with your bills again when using SurePay.

DIGICEL

COLUMBUS (formerly Karib Cable)

LUCELEC

LABORIE COOPERATIVE CREDIT UNION

NICNATDIRECT (ONLINE SHOPPING)

LIME/FLOW (CABLE, INTERNET, LANDLINE OR MOBILE)

PAN AMERICAN LIFE INSURANCE

WASCO

UNITED INSURANCE

And More

Ordinary Shares also referred to as withdrawable shares are special deposit savings accounts. You must be a Member (with at least $100 worth of Permanent Shares) to save to/have Ordinary Shares. Monies on these accounts can be used to secure loans taken with the credit union. Members are allowed to withdraw from only the available amounts (amounts not securing loans). Ordinary shares used to secure loans are placed on hold (pledge) until the loan is paid off or reduced sufficiently that the risks are minimal. Members can withdraw any available shares not being used to secure their loans at anytime they wish to.

Members are encouraged to save as much as possible to ordinary shares. Special arrangements are made with members with loans to encourage monthly savings while making their loan payments.

Members are paid interest on their Ordinary Shares quarterly usually in March, June, September and December. The interest rates to be paid re determined by the Board of Directors. The more shares you have, the greater the interest amount received.

Members have the additional benefit of claiming a tax deductible on shares saved annually to the maximum of XCD$5,000 when filing their annual income tax returns.

Are you looking to start up a new business of expand and improve your existing business. No matter what size we can help with the needed funds by way of an affordable business loan.

Come in or apply online for such a loan using our downloadable or online forms on our website in our "Forms" section.

Requirements:

The Smart Start Club and Account was set-up as a fun way for parents to teach and encourage their children between the ages of 0-9 years old how to save.

Account features:

Eligibility:

Requirements to open account:

Characteristics of account:

The Family Indemnity Plan can help provide an extra measure of comfort during difficult times. It is an insurance plan designed to cover up to six (6) persons on a single contract, paying cash benefit which can be used to cover the funeral expenses for you and the eligible family members. There are six (6) coverage options available so you can choose the one which best suits your needs. Any member, spouse, or parent of the member who have not yet reached age 76, may enrol in the plan with no medical examination required. The plans are as follows:

|

|

||

|

Plans |

Benefit |

Monthly Premium |

|

A |

$5,000 |

$26.40 |

|

B |

$7,500 |

$39.60 |

|

C |

$10,000 |

$52.80 |

|

D |

$15,000 |

$79.20 |

|

E |

$20,000 |

$105.60 |

|

F |

$25,000 |

$132.00 |

|

G |

$30,000 |

$158.40 |

Who are the eligible members covered?

ALL ADULTS (not dependents) need to join the plan before reaching age 76.

Is your dream to some day build and own your own home? This usually starts with the purchase of land. Have you found the perfect location to take that first step? Let us help you get started on that dream. Come in to speak to us about a loan to purchase this important and valuable asset.

Come in or apply online for such a loan using our downloadable or online forms on our website in our "Forms" section.

Requirements

Security : At Least 5% in Ordinary shares and Mortgage/Hypothecation

Maximum Term: 15 years

Are you ready to take that important step to owning your own home? Whether it is to purchase a house and land package or to construct your own house, come in to talk to us. Let your friendly credit union help you attain this dream with a hassle free and affordable loan.

Come in or apply online for such a loan using our downloadable or online forms on our website in our "Forms" section.

Requirements

Security : At Least 5% in Ordinary shares and Mortgage/Hypothecation

Maximum Term: 25 years

For House and Land Package:

For House Construction:

Looking for a way to send money to relatives, friends or business associates around the world? Do you want a quick and efficient way to receive much needed funds from relatives overseas? Do you want to send money to someone overseas to purchase much needed, groceries, electronics, clothes and other items? You mom living in New York has a medical emergency and you need to send money to help with the bills fast and easy? Our MoneyGram facility provides a fast, easy, cheap and safe way to send and receive money worldwide.